r&d tax credit calculation software

Prepare Your RD Credit Get Cash Back. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim.

Turbotax Review 2022 Pros And Cons

This credit appears in the Internal Revenue Code section 41 and is.

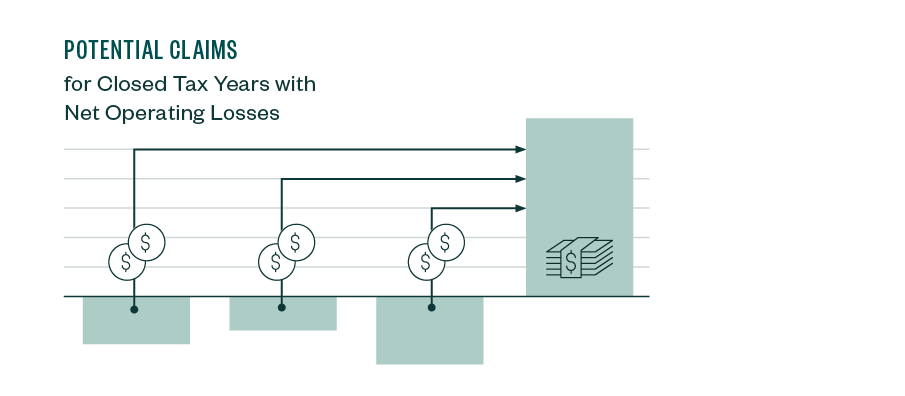

. This allows companies to either recover taxes paid in the prior year or continue to carry. To document their qualified RD expenses businesses must complete the four basic sections of Form 6765. Enquire now so Lumo can fully optimise.

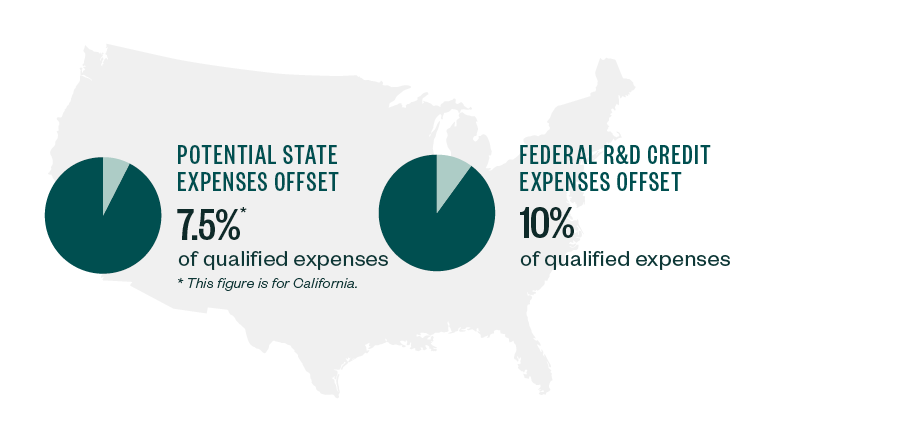

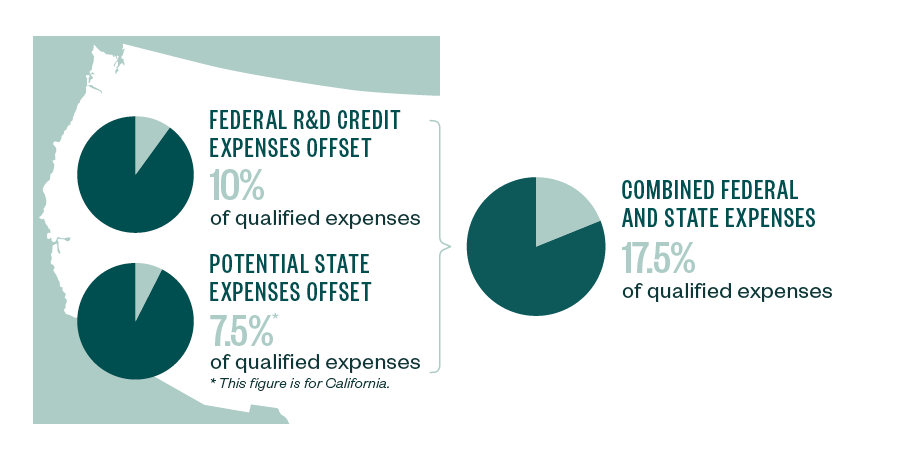

First file the RD tax credit on Form 6765 Credit for Increasing Research Activities which is a part of your 2021 annual corporate form 1120 US Corporation Income Tax Return. For most companies the credit is worth 7-10 of qualified research expenses. Dollar-for-dollar reduction in your federal and state income tax liability.

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. The results from our RD Tax Credit Calculator are only estimated. A to Z Constructions average QREs for the past three years would be 48333.

Our RD tax credit calculator. Well Handle The Entire Process For You. Fifty percent of that average would be 24167.

The results from our RD Tax Credit Calculator are only estimated. Risk free no obligation. You consent to receiving.

NeoTax Prepares a Study and Filing Instructions for Your CPA. The RD tax credit research and development tax credit is a state and federal tax credit that rewards companies that create develop new products or processes or improve an existing. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

Ad Early Stage Startups Can Claim the RD Tax Credit. RD Tax Credit Calculator. Helping Qualified Businesses Significantly Reduce Their Tax Bill.

Prepare Your RD Credit Get Cash Back. Up to 12-16 cents of RD tax credit for every qualified dollar. Estimate your RD credit with our quick calculator.

The ASC approach enacted in 2006 makes this calculation a bit easier with respect to the base amount rather than utilizing information from 1984-1988 a taxpayer can now elect on an. The RD tax credit can be carried back one 1 year and forward for a period of 20 years. Tracks time and automatically sends surveys to clients.

This is a dollar-for-dollar credit against taxes owed. If You Dont Qualify You Dont Pay. Simply put the RD tax credit creates money that goes back into your companys pocket to fuel further innovation and growth.

For startups applying the. Follow up and gather more documents from anywhere. Architecture Construction Engineering Software Tech More.

Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim. Use our simple calculator to see if you. Ad Pilot Helps Your Business Maximize Savings.

Please provide your information below to receive your report. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process. See If Youre Eligible To Claim A RD Tax Credit.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. These benefits can include the following. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques.

Architecture Construction Engineering Software Tech More. Ad Aprio performs hundreds of RD Tax Credit studies each year. Many businesses are still unaware that RD credit.

See If Youre Eligible To Claim A RD Tax Credit. Rd tax credit calculation software Friday June 3 2022 Edit. RD TAX CREDIT CALCULATOR.

If in 2022 A to Z Construction had. Section A is used to claim the regular credit and has eight lines of required. Busineses In Technology Ecommerce Bio-Tech More Can Qualify.

Many businesses are still unaware that RD credit eligibility extends beyond product development to include activities and even operations such as the latest manufacturing methods software. See If You Qualify. NeoTax Prepares a Study and Filing Instructions for Your CPA.

The Titan Armor RD Tax Experts are compiling your personalized report. Ad Aprio performs hundreds of RD Tax Credit studies each year. Cloud-based Software For The RD Tax Credit.

If You Dont Qualify You Dont Pay. Ad Early Stage Startups Can Claim the RD Tax Credit. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process.

Plus it carries forward 20 years.

R D Tax Credit For Software Development Leyton Usa

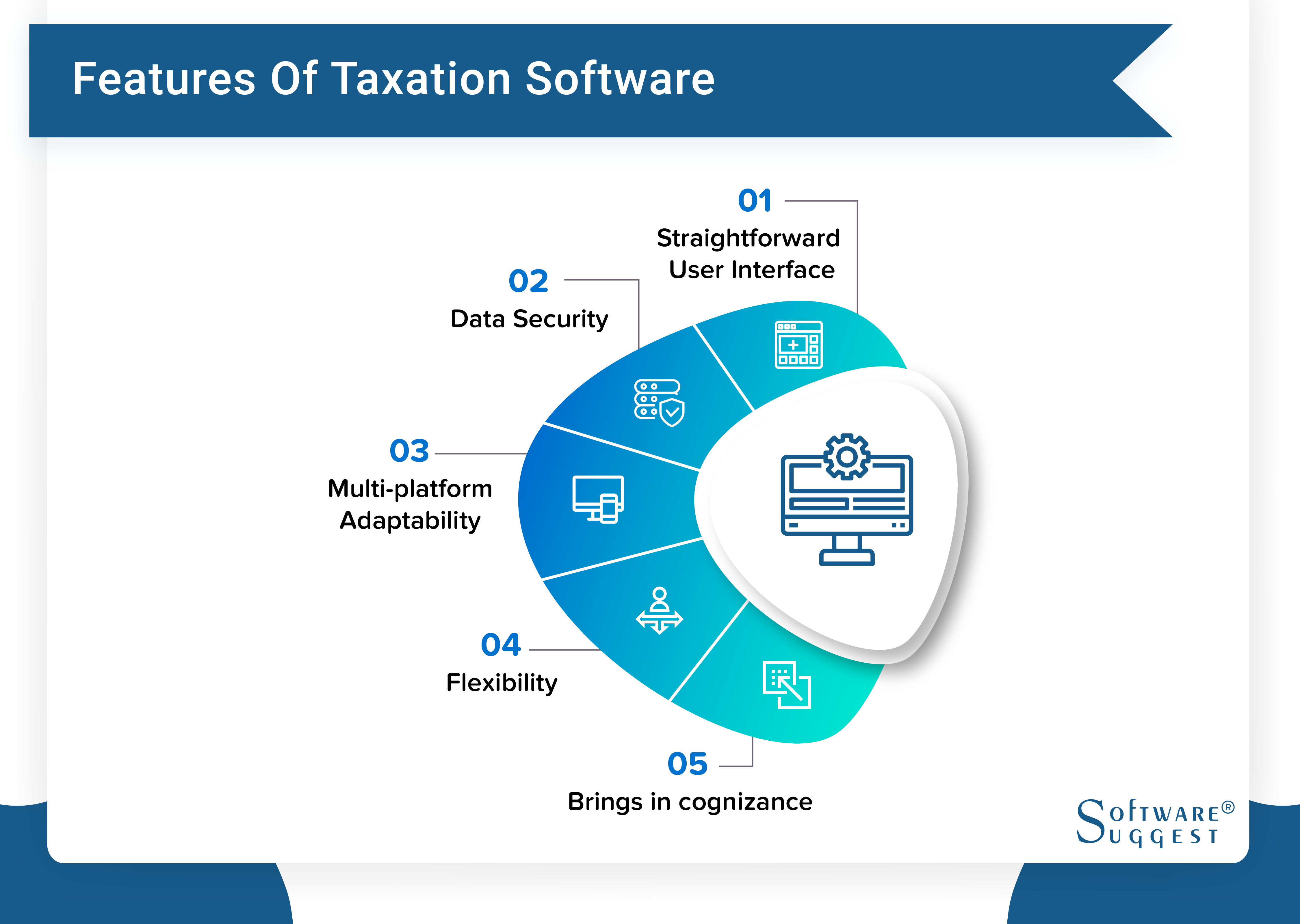

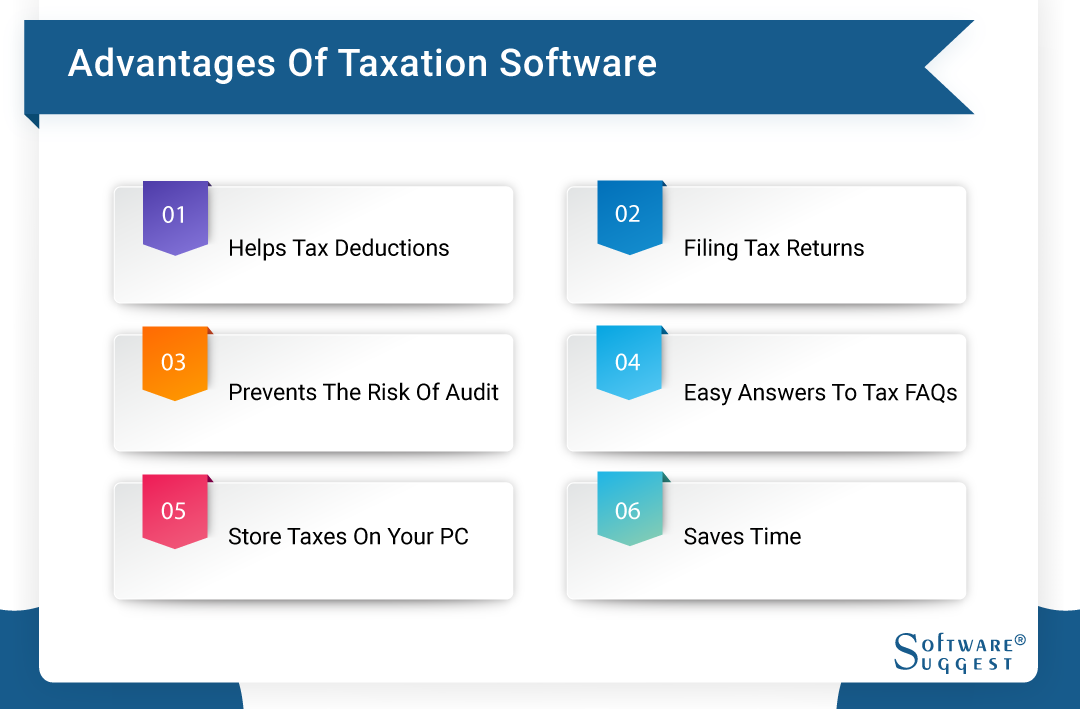

30 Best Taxation Software In 2022 Get Free Demo

Tips For Software Companies To Claim R D Tax Credits

Software Development Industry Tax Credits R D Tax Credit

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

30 Best Taxation Software In 2022 Get Free Demo

Research Insights Business Trends Getapp Resources Small Business Infographic Cloud Computing Clouds

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

Tips For Software Companies To Claim R D Tax Credits

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

2021 Tax Software Survey Journal Of Accountancy

Tips For Software Companies To Claim R D Tax Credits

Contrarian Strategy Meaning Execution Advantages And Disadvantages In 2022 Marketing Trends Financial Management Strategies

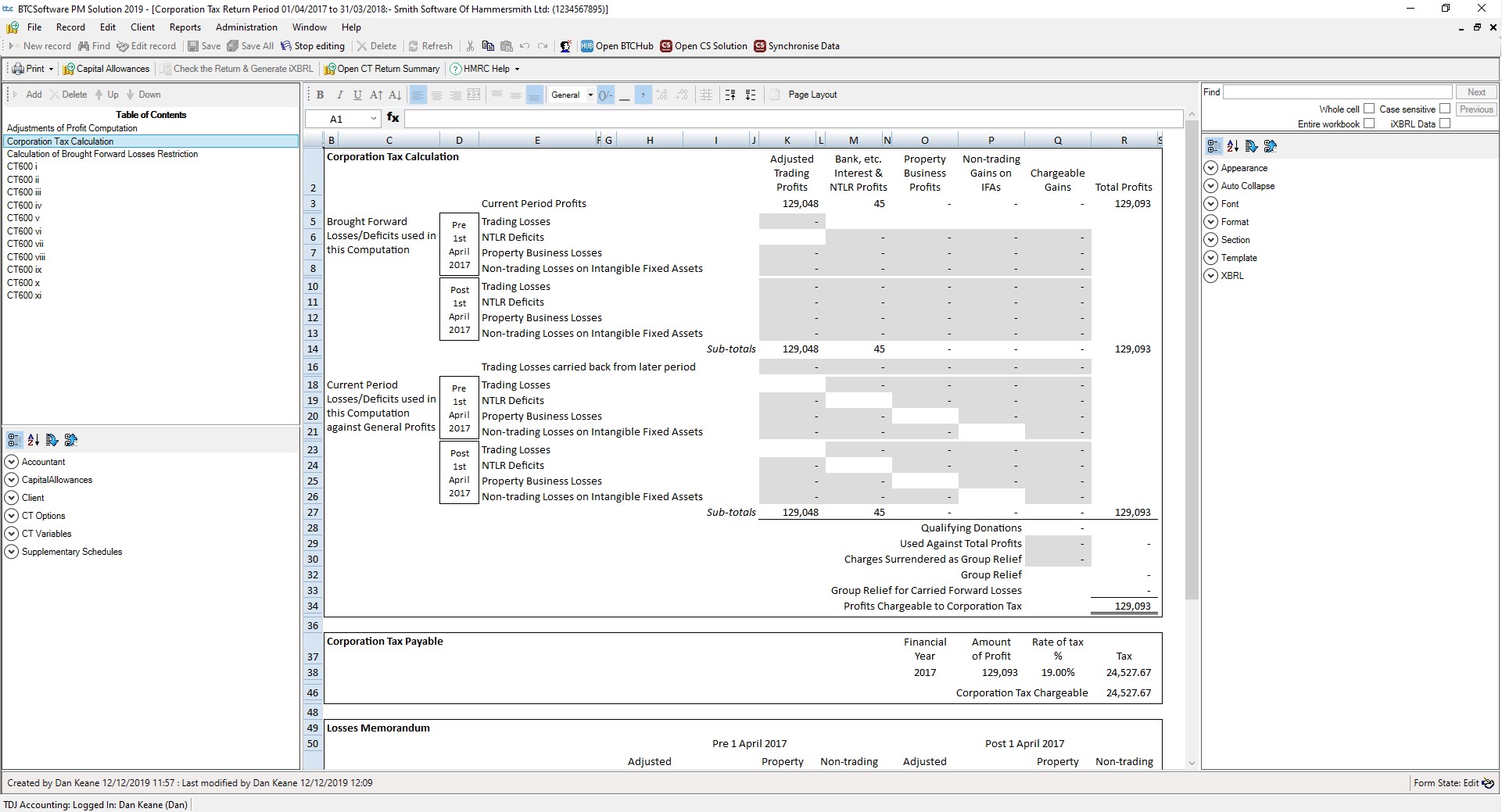

Corporation Tax Return Software Ct600 Hmrc Compliant Software

2021 Tax Software Survey Journal Of Accountancy

![]()

Timesheet Software For R D Tax Credits Replicon